Skyrocketing insurance premiums threaten people’s ability to live and prosper in North Queensland

Home insurance has skyrocketed everywhere, but property owners in the North are being slugged the most.

Many have chosen to opt out of insurance altogether.

According to the recent ACCC report, the rate of uninsured households in the North is now double the rest of the country.

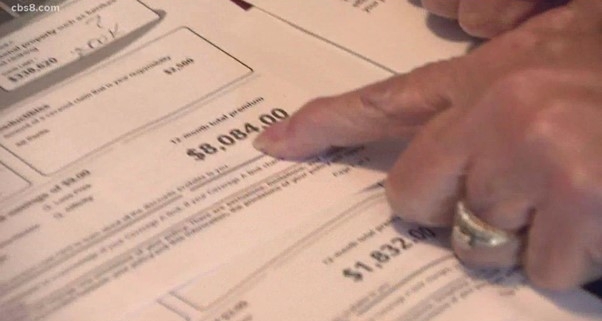

The other day I had a call from a constituent whose mother had just received her latest home insurance renewal notice from Suncorp.

The poor lady was shocked to find her premium had increased more than 25% to $6,100.82.

(Over $1,000 of that amount was State Government Stamp Duty and GST).

The Mum is on a pension of just $26,000 a year, and a $6,100.82 insurance premium would reduce that to just $19,900.

She is not alone in this either.

My electorate phone rings constantly from people in distress after being hit with similar premium hikes, or even refused coverage altogether.

Those calls are just a drop in the bucket of what is happening throughout Queensland’s reef-adjacent regions.

Many are scrambling to find affordable coverage, often calling dozens of companies to find one willing to cover them at a reasonable price.

Flood cover is now pretty much out of reach for most people.

One couple told me they received quotes of between $15,000 and $20,000 for flood cover on their property in an area designated as ‘flood risk’, despite it never having flooded in the 30 years they had been there.

The blowout in insurance costs is adding significantly to the financial stress of households already struggling with similar hikes in mortgage payments, groceries, fuel and electricity.

Something needs to be done to fix it, and I’m not talking about another round of ‘disaster mitigation project studies’ money for councils either.

First up, stamp duty on insurance should be abolished.

It’s a complete tax rort and needs to go.

Other things the government could do would be direct subsidies and rules that insurers provide a minimum number of policies in northern Australia.

Insurance is not a luxury, it’s a necessity, and it’s disgraceful that it is our old people and other vulnerable groups who are being made to suffer the most.

There’s only so much you can cut back on, when you’re a pensioner.

Leave a Reply

Want to join the discussion?Feel free to contribute!